Imagine you’re in your favourite pub…

The bartender pours your drink and you tap your card to the machine.

However, rather than paying with cash you’ve deposited in the bank…

You pay with gold securely stored in a Swiss vault on your behalf.

It sounds a bit unusual, doesn’t it?

Like something a Bond villain might do?

But thanks to TallyMoney, it’s now very much a reality.

In fact, with Tally, you can pay for anything with gold – your groceries, your clothes, even your bills.

You see, when you transfer pounds into your account, we immediately buy gold on your behalf. The gold is denominated in “tally.” And each tally represents a milligram of physical gold, which you can use as everyday money through our app and debit card.

Now, being able to brag to your friends that you just paid for the last round with precious metal is good. But the reasons for using a Tally account run much deeper.

Most notably, because your wealth is stored in gold, it’s never lent out, leveraged, or invested without your knowledge — which we believe is vital in an era where traditional banks are free to take as much risk as they want with your cash.

Indeed, taking back control of your money is reason enough to consider storing at least some of your savings in tally at any time. But there are also several developments taking place right now – some well-known, others less so – that make it a particularly good time to take the leap.

Over this two-part series, we’ll show you five of the most important.

In this first part, we’ll start by looking at two very timely reasons you should think about using a Tally account. Then, in the second part, we’ll look at three more very sensible reasons.

Reason #1:

Gold is at an all time high

Gold is at an all time high

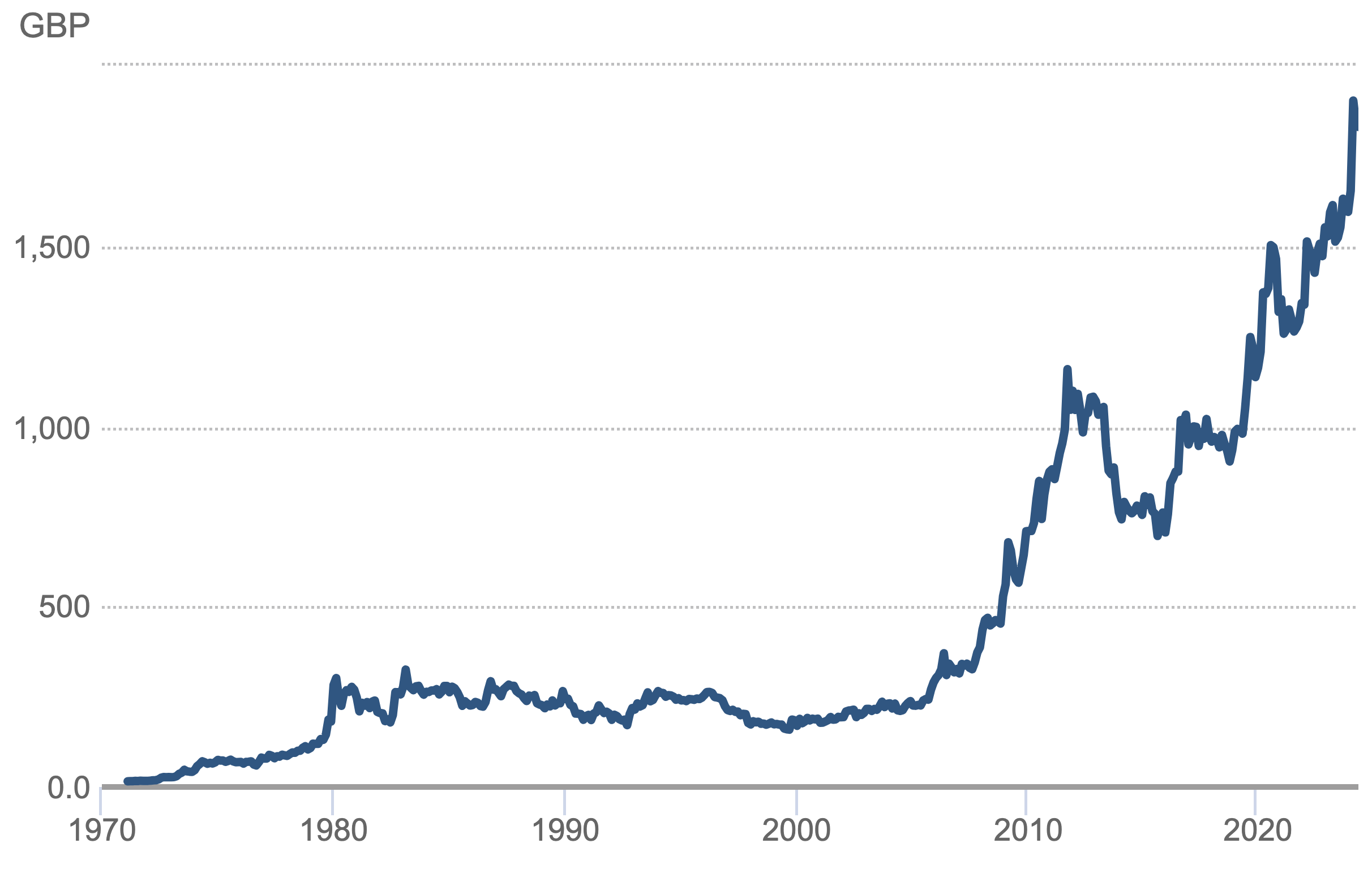

Take a look at this chart…

Gold may have had a decent run during Covid. In fact, for a time, it hit a new high every day for an entire week, reaching up to £1,954.62.

As has long been the case, gold is being propelled forward by global uncertainty. Currently, traders are worried about ongoing international conflicts, instability in various regions, and the looming threat of rising inflation.

Gold offers a safe haven completely uncorrelated with day-to-day stock market volatility (we’ll look at this more in the second part of this series). And the good news is that this dynamic is expected to continue in a big way.

In fact, some experts believe gold prices could even reach $7,000 an ounce by 2030. That’s roughly £5,500.

Unfortunately, this doesn’t mean a lot for your savings if they are held in cash in a traditional bank. Indeed, as gold continues to shine, the most you’ll have to look forward to is a (likely marginal) increase in your current account interest rate.

This is where having a Tally account comes into its own. Because each unit of tally represents one milligram of gold, the value of your account tracks the gold price. In turn, it means if the price of gold rises by as much as expected, so too will the value of your savings.

Reason #2: Traditional banking could become much more expensive

Reason #2: could become much more expensive

If you ask us, UK banks have a lot to answer for.

Now we’re hearing that they plan to offset rising regulation costs by charging fees for holdings accounts.

Worryingly, the Financial Conduct Authority said it “would not stand in the way” of this move to end Britain’s free banking model. It’s shocking stuff. And you must wonder: where will it all lead? Charges for checking your balance? For changing your PIN?

It’s all possible. And the idea that UK banks can effectively tap you up for more money with no added service whenever they are required to pay more by the regulator is concerning. Frankly, it feels tasteless against a backdrop of UK banks reporting record profits as the rest of the UK struggles through a cost-of-living crisis.

Here at Tally, we strive to offer something fairer and more transparent.

With Tally, you’ll only pay a one-off account activation fee of £29 and an annual account keeping fee of 0.5% (min. £3 a month). Transfers in have a fee, but you can withdraw your money at the spot price anytime you want.

No unexpected fees… no price hikes… no nonsense.

Just fuss-free everyday spending backed by gold.

We believe banking should be more transparent. It should be fair. And we believe you should be rewarded for the money you have in your account. We believe Tally makes that possible.

And as you can see, with gold set to continue its march upward and traditional banking set to become even more expensive, now is a great time to start making the most of what we offer.

But these are just two of the many reasons why we believe Tally makes sense… in the next part, we’ll look at three more.