When you deposit money into a TallyMoney account, you’re exchanging one currency for another.

Like you’d swap your pounds for euros if you were going to France…

You’re swapping your pounds for tally because you want to increase your savings.

But why?

Why are your savings more likely to increase in tally, rather than pounds?

Well, because the pound is a fiat currency, it means it’s not backed by anything—the government can print more pounds whenever they like.

In some way, that might sound like a good thing—a greater money supply means more to go around, right?

But as you likely know already, it doesn’t work like that.

It actually works like you’re slicing a pizza.

If you cut it into four slices, each slice would be quite large. If you cut it into eight slices, they would be smaller. If you cut it into sixteen, they would be even smaller still.

The same principle applies to money.

When a government increases the money supply, it’s like cutting the pizza into more slices. This is what we know as inflation, and it leads to each individual pound becoming less valuable.

Inflation reduces the purchasing power of the money in your account.

But tally isn’t a fiat currency.

A new type of currency

Unlike pounds, euros, and dollars, tally is a currency tied to real, tangible value.

Each unit is of tally represents 1 milligram of actual, physical gold stored in a secure Swiss vault on your behalf.

This means the value of your tally tracks the gold market and in turn, your savings increase when the value of gold increases.

And over the long run, gold always tends to increase.

Which is great. But you might wonder: why not just buy gold? Why put your money in an alternative currency like tally?

Well, for many, the main problem with physical gold is that it saddles you with a host of practical limitations.

Remember, we’re talking about an extremely valuable precious metal. You need to pay to keep it somewhere safe while you hold on to it (assuming you don’t want to bury it in the garden). And buying and selling it is expensive and time-consuming, involving days or even weeks of identification, verification, and transportation.

Of course, you can always use a gold investment platform to

handle these administrative burdens for you. But still, there’s a significant cost associated with buying, holding, and selling gold that will still be passed down to you.

Going down that route will still eat into your returns and make it hard for you to access your savings when you want to or need to.

This is where we offer something different and—we think—far superior.

Gold gains with the flexibility of a currency

When you store your wealth in tally…

You own gold in the form of a currency you can spend like any other.

This is crucial.

And it means you get the best of both worlds.

You get instant access to your savings whenever and wherever you want… AND you get the potentially market-leading returns associated with investing in gold over the long-term.

What’s more, because of how we set up TallyMoney as a company, we’re able to charge much lower fees for buying, holding, and selling the gold your tally represents.

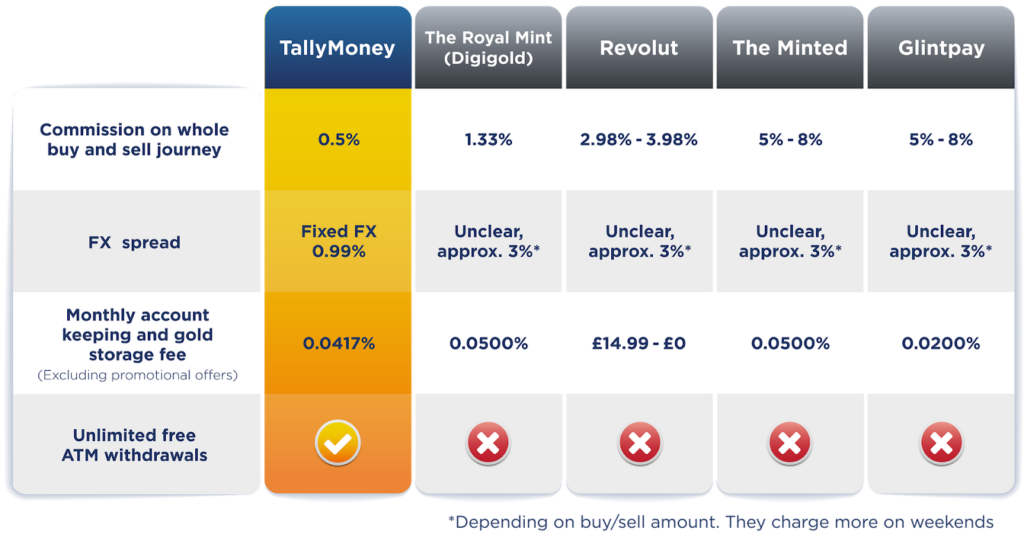

You can see how we stack up in the table below:

The fee comparison provided was accurate at the time this blog was published and may be subject to change.

So, as you can see…

Storing your savings in tally means you get the benefits of owning gold…

But with all the versatility of a fiat currency account you’re used to.

We think it’s the perfect combination.

We think it’s how money should be.