Any interest rate below the rate of UK inflation means your money is still losing purchasing power. Assuming inflation reaches 8% and you’re only earning 1% on savings, you’re effectively losing 7% of the money you’ve saved. It’s like another sneaky form of taxation.

How inflation affects your money

Inflation silently eats away at your savings; it happens silently because you won’t see your bank balance going down.

Instead, you’ll simply be able to buy less with the money you’ve saved compared to when you initially deposited it. This is because inflation drives up the price of goods and services.

Why the interest you earn on savings is not a solution

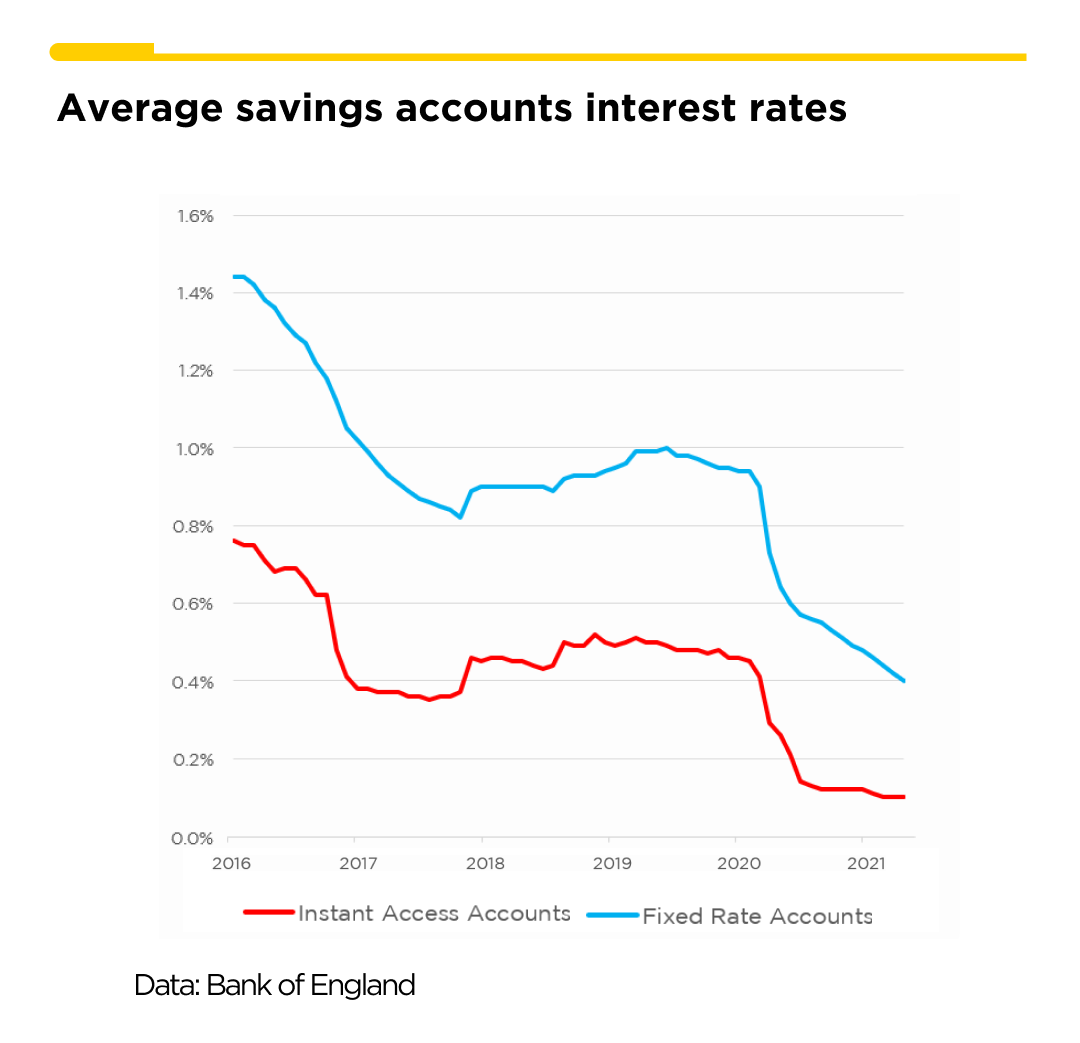

Most savings accounts currently offer interest rates lower than 1%; which is bad news if that’s where you keep your money.

Any interest rate below the rate of UK inflation means your money is still losing purchasing power. Assuming inflation reaches 8% and you’re only earning 1% on savings, you’re effectively losing 7% of the money you’ve saved. It’s like another sneaky form of taxation.

How you can fight back against inflation

That’s one of the reasons we created Tally: to protect the long-term value of your savings. Our savings and platform and app makes it possible to save in physical gold instead of government-issued currencies like pounds and euros.

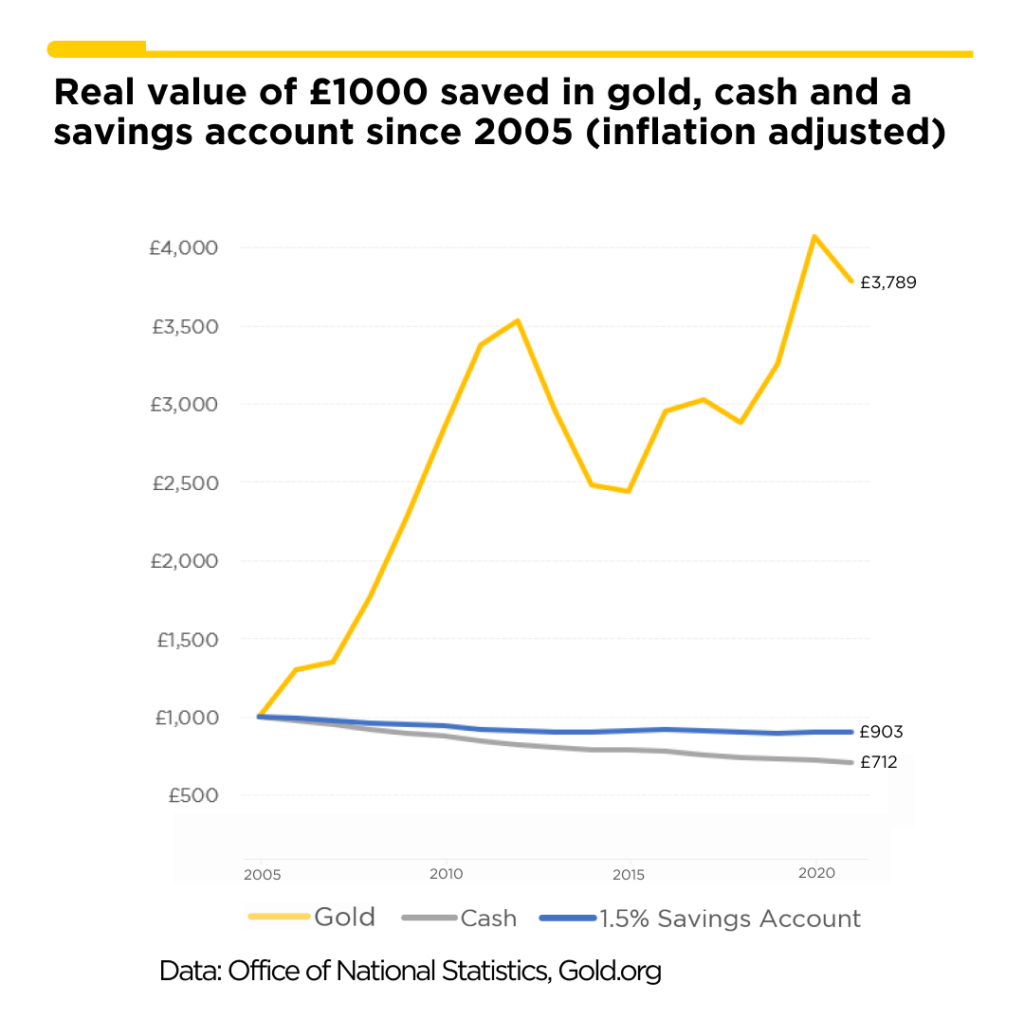

Because, whilst physical assets such as gold fluctuate in value based on supply and demand, they aren’t affected by an increase in the amount of money the government “prints”.

Moreover, gold is proven to hold its value over time, which in turn can provide savers with safer long-term purchasing power.