Retirement should be about security, stability, and financial freedom—but for many UK savers, it’s becoming a game of uncertainty. And in light of recent concerns highlighted in pension news, many over-55s are questioning whether their savings are truly safe.

Will the government change pension rules again? Will retirees be forced to hand over more of their hard-earned savings?

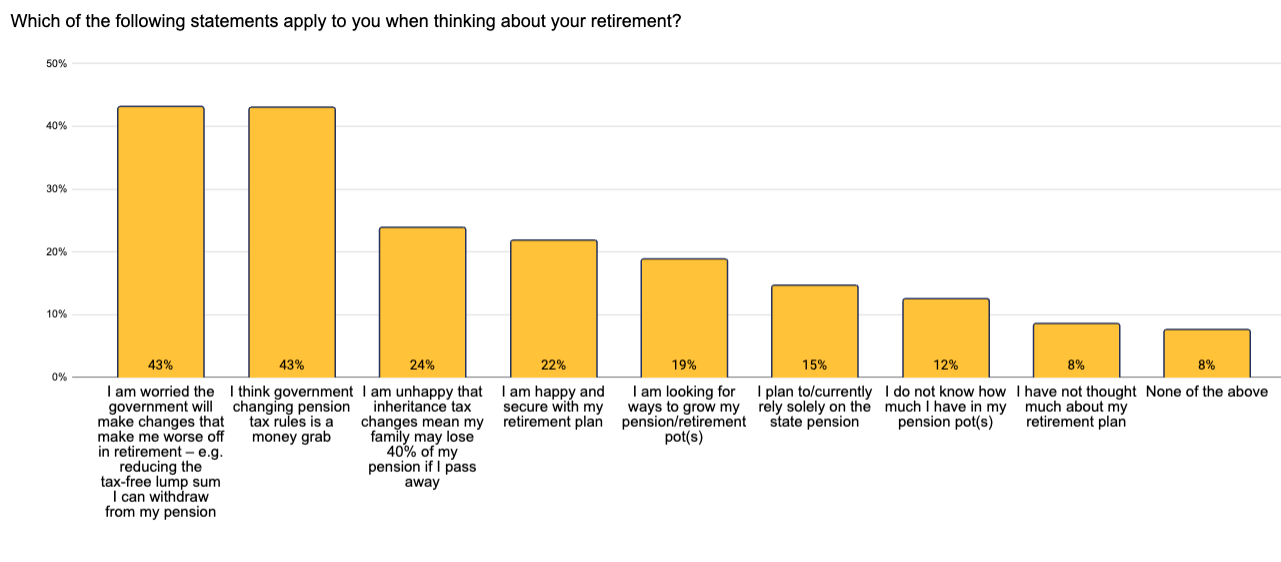

According to new survey data, 43% of UK adults aged 55+ fear government policy changes will leave them worse off in retirement—and they’re not wrong to worry. From potential changes to tax-free lump sum caps to inheritance tax hikes, pension pots are looking more exposed than ever.

Pension News: Is the Tax-Free Pension Lump Sum About to Shrink?

For years, UK retirees have benefited from a 25% tax-free lump sum withdrawal, capped at £268,275 . But with every Budget announcement, there are whispers that this could drop to 20% or lower.

That might not sound like much, but let’s break it down:

Pension News Breakdown: How Much Could You Lose?

If the tax-free limit is reduced from 25% to 20%, a retiree with a £500,000 pension pot would see their tax-free lump sum drop from £125,000 to £100,000.

That extra £25,000 wouldn’t disappear, but it would become taxable income, meaning the government gets a cut instead of it remaining fully in your pocket.

Depending on your tax bracket, this could mean thousands more paid to HMRC—an avoidable hit for those planning their retirement withdrawals carefully.

This isn’t just speculation – it’s a trend.

In 2015, pension freedoms were introduced, giving people more control over their retirement savings.

In 2021, the tax-free lump sum cap was frozen at £268,275, meaning its real value is eroding year by year (MoneyHelper).

In 2023, the government scrapped the Lifetime Allowance (LTA)—which might sound like a win, but also opened the door to new, more hidden tax changes.

Will the 25% tax-free allowance be next? If the government needs more tax revenue, where do you think they’ll look first?

Looking for a tax-smart way to protect your lump sum? See how TallyMoney works

Pension News: Is This a Money Grab? 43% of People Think So

The UK pension system has always been complicated, but one thing is clear: the rules change when it suits the government.

A staggering 43% of UK adults aged 55+ say pension tax changes feel like a money grab. Why?

Pensions are one of the biggest untapped sources of government revenue. The UK pension market is worth £3.7 trillion (Theia)—a tempting target when tax revenues need a boost.

Inheritance tax (IHT) is becoming a bigger burden. 24% of respondents are already worried their families will lose 40% of their pension when they pass away.

Rising state pension age means fewer people qualify for full benefits. The minimum state pension age is set to rise to 67 by 2028, with potential increases to 68 or even 70 in future.

And what about the silent tax? Inflation.

Even if tax rules don’t change, the government still wins when inflation reduces the real value of pension savings. If your pension fund doesn’t keep pace with inflation, your future purchasing power shrinks.

Are You Really in Control of Your Pension?

The uncomfortable truth is that pension policy changes aren’t made with retirees in mind. They’re made to balance government budgets—and retirees are the ones paying the price.

Yet, despite these risks:

12% of UK adults aged 55+ don’t even know how much is in their pension pot.

8% haven’t thought much about their retirement plan.

15% plan to rely solely on the state pension—which currently pays just £11,500 per year (less than minimum wage).

If pensions are at risk, and government policies aren’t looking out for you, who is?

This is why more people are taking control of their wealth before the rules change again.

Read more about the benefits of investing in gold with TallyMoney

Why Cash Savings Aren’t the Answer for Pension Security

Many pre-retirees think the safest option is to withdraw their pension and keep the money in cash. But here’s why that may not be the best financial move:

Banks offer low interest rates. Most savings accounts pay less than inflation, meaning your money is shrinking in real terms.

Cash savings are an easy target for taxation. Unlike assets like gold, cash is fully visible to tax authorities—which means it’s the first thing that gets taxed when new rules come in.

Currency devaluation means your money buys less over time. Inflation at 4–6% per year means £100,000 today will have the spending power of just £80,000 in five years.

Whilst money in a traditional bank account is protected by the FSCS up to £85,000, any amount over this is potentially exposed should anything happen to that bank—anyone remember Northern Rock? In order to keep larger sums protected (such as larger withdrawals from a pension pot), people need to open multiple accounts across multiple clearing banks, leaving you with more admin and headaches for a very low return.

So, if pensions are at risk and cash savings aren’t safe, where should retirees look?

Pension News Reaction: The Search for a More Secure Alternative

This is why more pre-retirees and retirees are looking for alternative ways to store their savings.

Gold has been a store of value for thousands of years, holding its purchasing power while currencies lose theirs. Whilst it’s true that the value of gold in GBP does fluctuate (up and down) in the short term, it has proven to hold its value over time, and has increased (on average) by 10% p.a. since the year 2000. It’s not just a hedge against inflation – it’s a way to keep money outside of government-controlled financial systems.

Unlike traditional pension savings:

Gold doesn’t lose value due to inflation. While the pound weakens, gold remains stable over time.

Gold isn’t subject to pension tax policy changes. Unlike pension pots, gold savings aren’t locked into government-controlled schemes.

Gold-based savings, like TallyMoney, offer liquidity without exposure to banking system risks. You can store wealth in gold but access it instantly whenever needed.

Final Thoughts: The Best Time to Act is Before the Rules Change

If 43% of people are worried about pension rule changes, that’s a red flag.

If pension tax-free allowances shrink, retirees could lose thousands in avoidable taxes.

If pensions continue to be a government revenue target, retirees need to rethink where they store their money.

Pension news changes fast. But one thing is clear: waiting to act is the most expensive mistake retirees can make.

Stay informed, stay ahead, and take control of your financial future – get your own independent financial advice before the next rule change costs you more than you bargained for.

The research presented in this blog was conducted online between 28th February 2025 and 3rd March 2025. The study was carried out with a sample size of 2,012 UK adults aged 55+. All research methodologies adhere strictly to the UK Market Research Society (MRS) Code of Conduct (2023) and comply with the Data Protection Act (2018) to ensure ethical and responsible data collection and processing.