“FTSE 100 hits record high…”

“FTSE 100 hits new record high…”

“FTSE 100 closes at record high…”

The news was heralded from the headlines.

The FT… Sky News… the Guardian.

They all reported on the fact and right now, it does seem stocks are riding high.

Or at least, markets are “up.”

The thing is, you don’t have to do too much digging to see the story isn’t all that rosy and could well be about to get much worse.

Don’t get us wrong, this isn’t to say you should sell out of the markets, lock the doors, and hide all your wealth. No. Here at Tally Money, we lean towards more sensible approaches to managing your money.

But while the headlines in the mainstream media tell of markets riding high, it can all be a bit confusing. Especially when you consider that many financial experts are predicting tough times ahead for stock markets.

We think it pays to understand what can happen and what alternative options you have on the table.

Is it a good time for stocks or a bad time?

First, let’s just put what “all time high” really means for your money.

Year to date, the FTSE is up roughly 7%.

That’s not bad. It’s not bad, but it’s not great.

In the US, the Dow is up 8%. Again, it’s a return. But it’s nothing to write home about. Especially when you consider over the same period, gold is up nearly 25%.

This is one of the main worries with stock markets: they tend to rise slowly, but they can fall quickly. And there are people predicting we could indeed be walking into a period of rapid decline.

Economist Harry Dent told Fox News:

“I think 2024 is going to be the biggest single crash year we’ll see in our lifetimes.”

He went on to say:

“This is the one time I’m telling you, do not listen to your financial adviser. Things are not going to come back to normal in a few years. We may never see these levels again. And this crash is not going to be a correction. It’s going to be more in the ’29 to ’32 level.”

This is a bold prediction. And Dent could be right or wrong — we don’t know. But he’s not the only celebrated financial voice suggesting things aren’t looking so good right now.

John Hussman, who predicted the 2000 and 2008 crashes, writes:

According to Business Insider, he goes on to suggest that the current “all-time highs” are a sign of big falls ahead. Like Dent, he sees this as a moment like the 1929 crash. He believes it could be huge and that investors trapped in stocks face a real challenge.

Dent and Hussman aren’t alone in seeing the combination of rising stock markets at a time of geopolitical uncertainty a cause for concern. Of course, there are respected voices that argue the counter too. There will always be those who are bullish and those who are bearish, those who think things are good, and those who think things are bad.

Either way, the fact remains that when the stock markets do crash, it can be disastrous if your money is overly exposed to those markets.

Most recently, during the coronavirus pandemic, the Dow did indeed crash and lost investors a huge amount. In the space of just over a month, the index lost 37% of its value.

Before that, we all remember when the whole system jolted and dumped value like there was no tomorrow during the 2008 global financial crash. Almost all major indices lost 20% of their value, and the Dow lost a massive 54%.

It took four years for the Dow to fully recover.

Prior to that, you’ll likely remember the dot-com crash, when markets tanked again and the NASDAQ itself lost over 78% of its value.

Of course, these are key turning points in the market, and they are extreme situations. Yes, with stocks there is the chance of gains over the long run, and particularly if you’re invested in specific stocks that succeed despite these broader collapses, you can do very well. But still, crashes — like we saw in 2000, 2008 and more recently during the pandemic — are the risk we run when we store our money in the stock markets.

The Tally Alternative

Remember, only you can decide what you think will happen to the financial markets over the coming months and years.

You might be in the more bearish camp along with Dent and Hussman and believe we’re heading for a period of turmoil. Or you may feel more positive and believe the higher highs we’ve seen in the likes of the FTSE 100 are a sign of better things to come.

Whatever you believe, the most sensible option is often to make sure you’re diversified and hold positions with the potential to do well whatever happens.

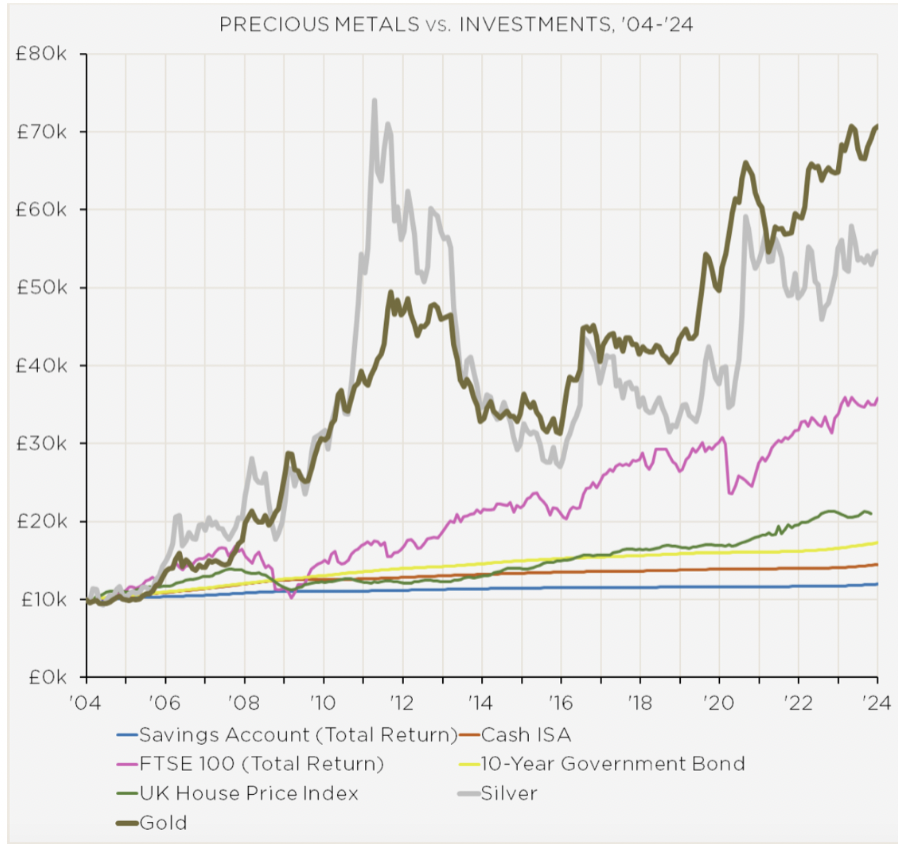

To that extent, it’s worth looking at this chart, which shows the returns you’d have made over the last 20 years with money invested in a range of different investments. You can see FTSE 100 is represented by the pink line. Take a look:

The first thing you might be drawn to is the brownish coloured line — it appears to have done the best over time and far outperforms the FTSE 100, house prices, and cash.

What is it? It’s gold.

And here’s the good thing about gold in terms of what we’re discussing today: not only does it tend to rise over time in excess of any other broad market investment, it also performs particularly well during stock market crashes and times of economic uncertainty. This is because it’s a real, tangible asset and investors see it as a safe haven.

But of course, gold is a precious metal, and it can be troublesome to invest in directly. Not only is there the cost of investing itself, but you also need to think about how you store your gold. Not everyone wants to buy and keep a secure safe, pay someone to look after their gold, or bury the stuff in the garden.

This is why — especially during times of economic uncertainty and stock market crashes — Tally offers a smart alternative to keeping all your money in the stock markets.

You see, when you deposit money in a Tally account, you are in fact buying gold. Every tally in your account represents a physical milligram of gold that is stored – on your behalf – in a vault in Zurich.

It means that your money moves with the price of gold. If the gold price goes up during stock market volatility, so does your money. And to be clear: it’s not like investing in gold… you ARE invested in gold.

But it’s investing in gold with an added bonus.

Thanks to Tally, you can also spend your gold at any time just as you would be able to if you had your money in cash or in a traditional bank.

It means you get the advantage of being invested in gold… being invested in an asset that is safer in times of stock market volatility… and being invested in something you can use as money too.

We don’t know when or even if the stock markets are heading towards a serious crash, but we do know that it’s sensible to make sure your money is protected in case they do. Tally helps you to do just that, with a whole heap of extra benefits.