Why do I have an issue with banks? They have their greedy fingers in everyone’s money.

That’s what the novelist Jon Raymond had to say about the financial institutions with whom the vast majority of us store our wealth.

We can see what he means.

The likes of Lloyds, HSBC, Barclays, and Natwest are all posting record profits right now. But at the same time, the average savings rate they are paying out to their customers is just 2.8% – well short of the 5.25% Bank of England base rate.

It’s frustrating.

And, as we enter a period where the BoE is preparing to cut rates after a prolonged period of hiking, we can’t help but feel like Mr. Raymond’s quote is more pertinent than ever.

Nor can we help but feel like our ability to help people make the most of their money has ever been more important.

Why? Well, the bottom line is, banks don’t like giving their customers any more than they have to. In fact, they’ll do anything they can to stop that from happening. As recently as last year, they flat out refused to pass down rate hikes to their customers, only doing so at the eleventh hour under the threat of FCA recrimination.

So, you can be sure as soon as the BoE starts to cut the base rate (by as many as four times this year, no less)… your friendly neighbourhood financial institution will also snatch away the very limited extra interest it had begun to pay you over the last couple of years.

The implications for the vast majority of savers who hold all of their wealth in the bank aren’t good. The money they are not spending will be doing absolutely nothing for them.

But thankfully, we provide something no UK current account can offer.

A Tally account gives you the flexible access to your money you need for your everyday expenditure… but when you’re not spending, it securely holds your cash in an asset proven to grow in value over time (at a record rate right now, too).

How? Well, it works like this…

Making your money work for you

When you transfer pounds into a Tally account, we immediately buy gold on your behalf. The gold is denominated in “tally”. And each tally represents a milligram of physical gold you can use as everyday money through our app and debit card.

It means you get to tell your mates at the pub you paid for their last round with gold.

But beyond this, investing your money in gold when you aren’t spending it actually gives you the opportunity to increase your wealth significantly over time.

You see, the Bank of England’s recent spate of interest rate hikes was something of an anomaly, designed to address soaring inflation in the wake of the Covid-19 epidemic.

That inflation has now cooled.

And while we might not see them drop all the way back to the levels we got used to in the wake of the Global Financial Crisis… ultra-low interest rates are now very much back on the cards.

This is not good news for savers.

Money kept in a bank account will not just deliver paltry returns — it’s likely to decline in value. After all, forecasts put inflation around the BoE target level of 2% for the foreseeable, reducing the purchasing power of anything earning less.

Thanks to TallyMoney, and the opportunity it offers to store your wealth in gold rather than bank deposits, this needn’t be the case.

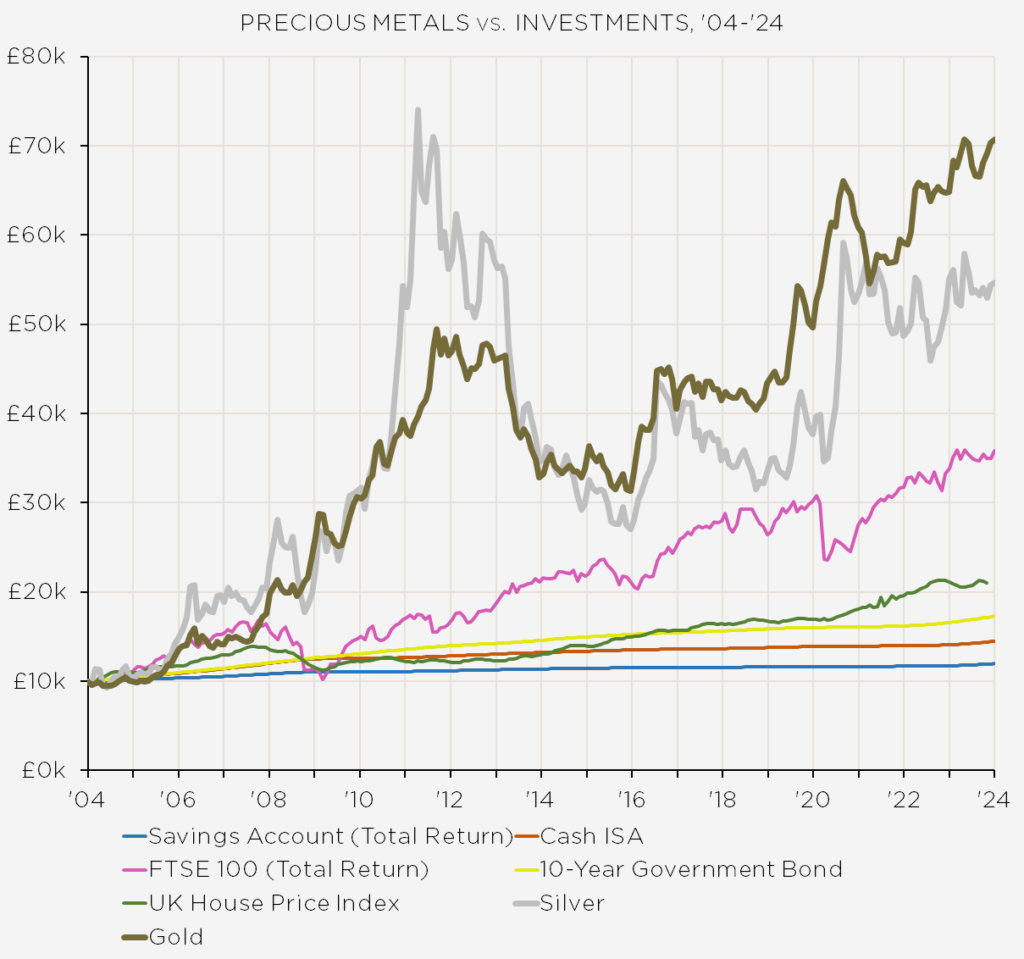

Just look at the chart below…

It shows £10,000 invested in various assets over the last 20 years – a period defined by low interest rates.

Money left in a typical savings account at the bank would be worth

£11,948 today – that’s the blue line. Money invested in gold, meanwhile, would be worth £70,710 – that’s the gold line.

That’s a difference of £58,762.

It’s huge. And it very clearly shows the true potential of your wealth – even in times when the banks aren’t looking too hot.

What’s more, where interest rates – and, in turn, current account savings – are set for a downward course from here… gold has never looked stronger.

The precious metal has repeatedly hit record highs over the last month, and sits at £1,832 an ounce as at the time of writing.

Moving forward, many predict this figure will continue to soar as traders use it as a “safe haven” amid market volatility generated by hot button topics like the Russia/Ukraine conflict and turbulence in the Middle East.

In fact, some experts believe gold prices could even reach $7,000 an ounce by 2030. That’s roughly £5,500 an ounce.

A safer alternative

Now, the prospect of watching your savings decline in value is bad enough. But there’s another element that makes storing your money in a bank account as interest rates fall even more frustrating.

It’s also another area where we can help.

You see, as well as paying you very little for their services, the fractional reserve system means banks are effectively allowed to do what they want with the vast majority of your money once it’s under their control.

If the risks they take go well? They keep the profits, and you get none.

If they don’t? You’re the one left holding the bag if they close, potentially unable to retrieve any funds beyond the £85,000 guaranteed by the Financial Services Compensation Scheme.

That doesn’t seem fair at any time. It definitely doesn’t seem fair as they prepare to pay you even lower interest rates while they continue to enjoy record profits.

It’s one of the main reasons we started Tally.

We don’t lend out, leverage, or invest your wealth without your knowledge. Instead, we store it in gold – specifically, gold held in a secure vault in Zurich. And, in the unlikely event anything ever happened to us, your gold would be promptly sold so its fiat value can be returned.

With Tally, you’re 100% in charge of your savings 100% of the time.