A lot of us don’t think twice about putting money in our current account.

We’ve done it our whole lives.

But the truth is, by doing so, you’re supporting a system designed to drain the value of your savings.

Thankfully, there’s another option now because TallyMoney gives us a choice in everyday money.

You can register to open your account and begin protecting your wealth and saving in physical gold here.

With TallyMoney, you’ll enjoy uplift in value over time of gold vs nominal interest paid by your bank, instant access to your money and tax advantages on any uplift..

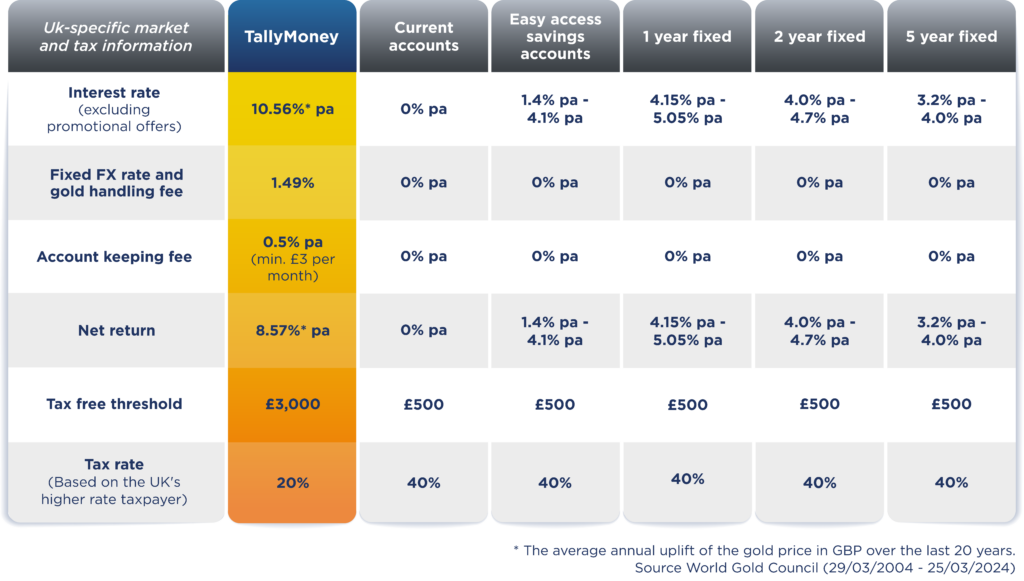

In fact, let’s take a look at how a TallyMoney account stacks up against the UK’s top savings accounts in the table here and break it all down below…

Interest rate

We take low interest rates as standard today. But we shouldn’t. It’s the return your bank is paying you for you giving them permission (it’s in the small print) to lend out your money for their profit. That profit is currently at a record high. Yet even a good account rate of 5.05% falls well short of the Bank of England’s 5.25% base rate. Gold has generated an average annual account return of 10.56% p.a. since the start of the century (since 2000) – more than double any bank rate. And rather than lend your money out for profit, TallyMoney stores gold for you in a secure Swiss vault. And through their app and debit card, you can use it as everyday money.

Fixed FX rate, gold handling and processing fee

Tally charges a fixed 1.49% on your deposits (free for transfers out and spending). It’s a deposit fee you won’t pay with a bank. But it’s the cost of getting out of pounds and in to physical gold. And gold’s 10.56% p.a. average annual return since 2000 is a LOT higher than the annual interest rate paid out by any current account. Sure, you can invest in physical gold in other ways. But with platforms charging upwards of 5% for transfers in and out of gold, none match TallyMoney on usability and low cost.

Account keeping fee

Banks brag about not charging account keeping fees, but they do indirectly by paying less interest on savings and charging more interest on loans. Whereas our fee is transparent so you know what your true cost of services is, and our fee ensures that your money stays safely vaulted and easily accessible. Banks don’t hold your money for safekeeping. They lend it out (because you’ve lent it to them – again, in the small print). If the loans default, you’re the one who risks losing your cash. Tally guarantees your money is safe and accessible around the clock, all of it, with no limitations on your account balance. We don’t lend out your money or lend against it. It’s yours, not ours, as it should be in our opinion. It’s all very boring, in fact – we hold your gold shown as tally in your TallyMoney account and keep it locked, safe and insured in a Swiss bank vault. That peace of mind is what the monthly account keeping fee 0.5% p.a. pays for (£4.17 p/month on £10,000 balance).

Net return

The next time you see your high-street bank bragging about its free accounts, it’s worth remembering that, on average, Tally pays nearly double what they can – even after our fees are applied. You may think twice about sitting your savings in an appreciating asset like gold. We admit it’s unusual in a world where banks are the norm and pounds are what we’ve been used to. But at the end of the day, we all want the greatest protection and return on our savings possible. With TallyMoney, you now have a choice. It’s up to you to pick what’s best for you.

No penalty for early withdrawals

Penalising you for accessing your own money is weird. Full stop. But the idea is that fixed accounts penalise you for early withdrawals because it messes with what they can earn from your cash. In exchange for not breaking the “agreement”, you get a higher rate for a certain period. But why settle for one or the other? At Tally, we give you the best of both worlds. We never charge you for account withdrawals. Plus, while your money is with us, it holds its value in gold, which historically outperforms even the best UK accounts.

Instant access

Accessing your money is a game of compromise with UK banks. Current accounts offer you instant access, but the interest rates they pay you are peanuts. Fixed accounts offer you better interest rates, but your withdrawals come with a wait and a charge. You’re better off with Tally. Whether it’s for clothes, groceries, or bills, your money is available whenever and from wherever you want it. And when not in use, it retains its value as gold, which historically increases against the pound at an average annual rate of 10.56%p.a. since the start of the century. So with Tally, you enjoy the flexibility of instant access with the security, stability and value of gold savings.

If your account provider fails – savings protection

If your bank goes bust, it’s their fault not yours. That’s obvious. So, why are we treated as if we personally pressed the self-destruct button when things go kaput in the UK? When banks close, £85,000 of your account balance is protected under an insurance-type structure called the Financial Services Compensation Scheme (though it can take more than a year to get your money back). And anything beyond £85,000 that is as good as gone. It’s a heavily flawed system that stacks the deck against savers. In the unlikely event of Tally’s closure, 100% of your unlimited gold balance will be sold, and the proceeds of sale, less a 1% admin fee, will be transferred in to your non-Tally account within seven working days.

Tax free threshold

The government will stick its hand in wherever your money is concerned. Your current account is no different. If you’re a higher rate taxpayer, you get to keep the first £500 you earn in interest every year. The taxman takes 40% of everything beyond this measly threshold. TallyMoney sets things straight by letting you keep more of what’s yours. When you transfer funds to another Tally customer, make payments with your TallyMoney Debit Mastercard, or take cash out, any gains or losses are treated as capital gains. So, you get to keep all of the first £3,000 you make (rather than £500). Then you pay 20% on anything else (rather than 40%). Another tick in the box for Tally.